Fixed Assets Depreciation Rate Chart Malaysia

27 june 2014 contents page 1.

Fixed assets depreciation rate chart malaysia. Rates real property gains tax stamp duty sales tax service tax other duties important filing furnishing date contact us disclaimer 2018 2019 malaysian tax booklet table of contents 2018 2019 malaysian tax booklet 5. Entitlement to claim legal ownership is required to entitle a claim to tax depreciation. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business.

Mpsas 3 accounting policies changes in accounting estimates and errors provides a basis for selecting and applying. We have a requirement to calculate tax depreciation for malaysia with reference to the capital allowance the scenario is like this. Allocation of tangible assets to tax depreciation lives and rates several tax opinions have expressed that if a movable asset is part of a building but does not constitute a sole unit with the building.

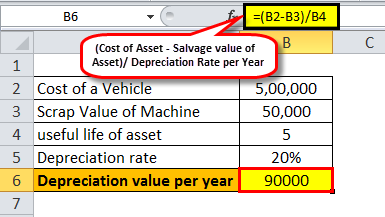

Relevant provisions of the law 2 4. Some examples of assets that are normally used in business are motor vehicles machines office equipments and furniture. For asset class say office equipments initial allowance is 20 and annual allowance is 10.

Inland revenue board of malaysia ownership and use of asset for the purpose of claiming capital allowances public ruling no. Again depreciation 10 per annum will be calculated on. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business.

Partnership asset 8 9. Malaysian public sector accounting standard mpsas 17 property plant and equipment is set out in paragraphs 1 109. Summary of changes 1 3.

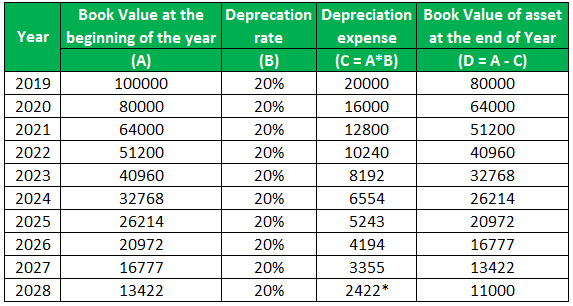

Mpsas 17 should be read in the context of its objective and the preface malaysian public sector accounting standards. 5 2014 date of publication. Depreciation rates for fixed asset and it s different classes with examples and thorough explanation.

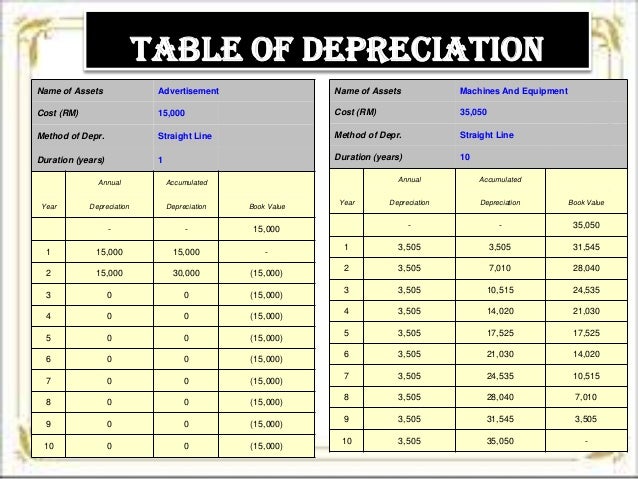

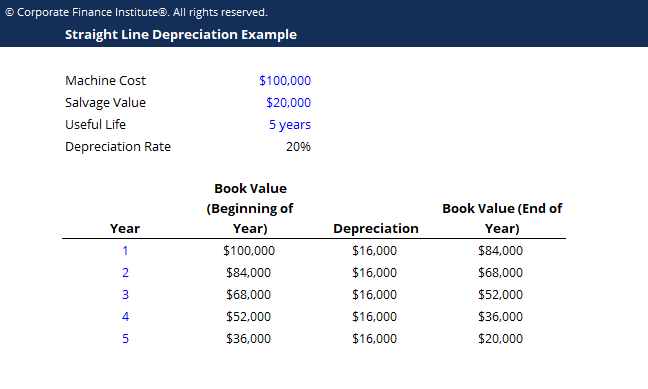

5 2 buildings other than those used mainly for residential purposes and not covered by sub items 1 above and 3 below. A fixed asset is a tangible asset that has a useful life of more than one year and from which future economic benefits are expected. That means depreciation will be calculated 20 on the acquisition value immediately upon acquisition for one time.

All the paragraphs have equal authority. Jointly owned asset 7 8. The reduction is due to obsolescence wear and tear or usage is.

Part a tangible assets. In order to qualify expenditure must be capital in nature and used for business purposes. 21 21 malaysian tax booklet income tax.

All fixed assets have a reduction in their value over time through depreciation as the result of their usages or impairment since the varying value is higher than the reliable value. Claims for capital allowance can be made in the relevant column provided in the. Depreciation refers to the decrease in value of an asset over a period of time.

In a previous article list of fixed asset depreciation calculation software a list of software was provided that caters to depreciation calculation. Ownership of the asset 4 7. The income tax act 1962 has made it mandatory to calculate depreciation.

Worldwide capital and fixed assets guide 2018 7 1.