Example Of Zero Rated Supplies In Malaysia

Exports 19 basic food items illuminating paraffin goods which are subject to the fuel levy petrol and diesel international transport services farming inputs sales of going concerns and certain grants by government.

Example of zero rated supplies in malaysia. Please share this 1 minute video after watching. What is the zero rate. Zero rated supplies currently selected.

This means no additional amount of vat will be added to the purchase price of zero rated. How gst works on a zero. It as an input tax.

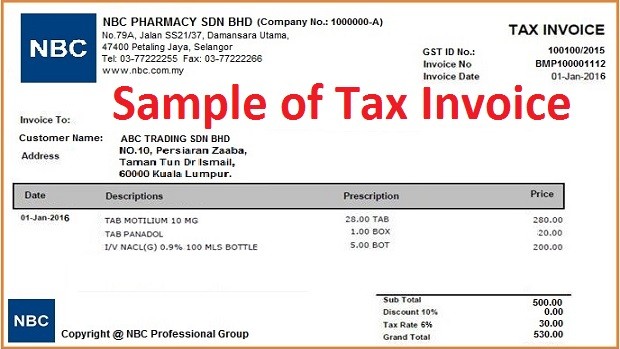

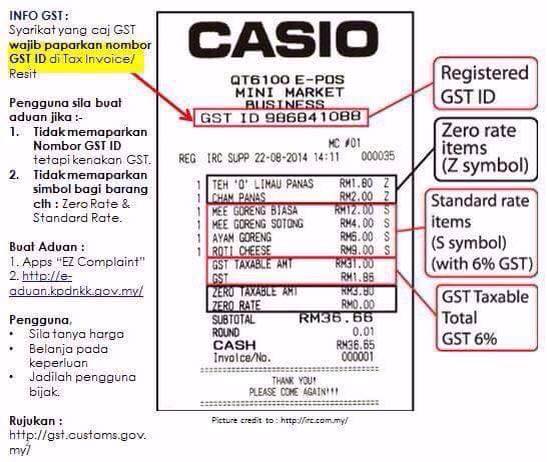

Suppliers do not charge tax on a zero rated or exempt supply. A supply of. A 272 goods and services tax zero rated supplies.

15 2 2013 23 36 these are taxable supplies that are subject to a zero rate. An exempt supply is not subject to vat. Below is the overview.

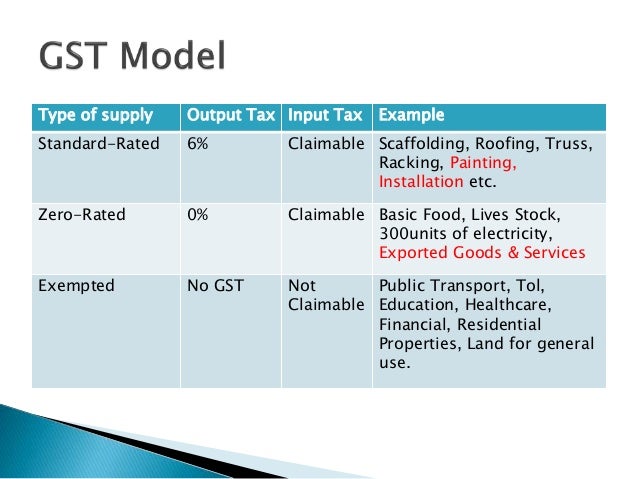

These are standard rated supplies exempt supplies zero rated supplies and supplies that are beyond the scope of goods services tax. Non fee related financial services educational services. Goods services that fall under each of these categories are pre determined by the rcdm royal custom department of malaysia.

In malaysia gst largely falls under 4 different categories. Services in malaysia for example pilotage salvage or towage services international services for example transport of passengers or goods from a place in malaysia to a place outside malaysia for full list of zero rated goods services please download here. The definition of zero rated items are supplies of goods or services specified in the vat act that can be billed at 0 vat.

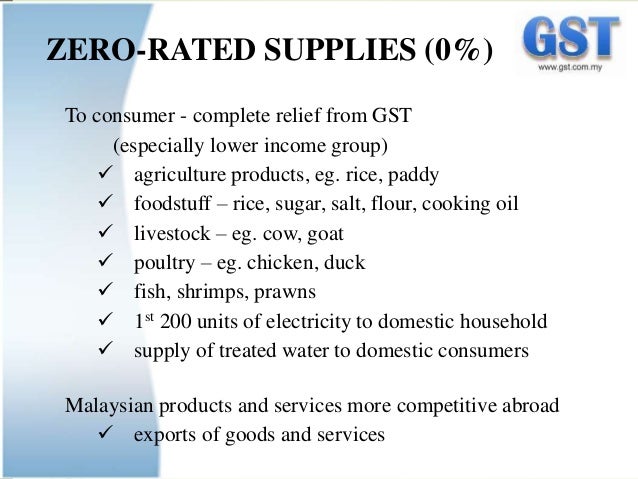

Examples of taxable supplies that are subject to a zero rate are exports agriculture products livestock supplies poultry egg treated water and the first 200 units of electricity to. Goods and services exempted from vat are. Zero rated vat items are defined below this video.

Zero rated and exempt supplies the following goods and services are zero rated. Gst treatment on government services. If you make supplies at the zero rate this means that the goods are still vat taxable but the rate of vat is 0.

There are taxable supplies that are subject to a zero rate. Zero rated vat items know them well and get it right with sars. Whilst input tax incurred in the making of zero rated supplies can be claimed input tax used to make exempt supplies cannot be claimed as a deduction.

Zero rated supplies last updated. The examples of zero rated supplies are goods such as basic food and utilities such as beef rice sugar water for domestic use and first 200 units of electricity per months for domestic use. Businesses are eligible to claim input tax credit in acquiring these supplies and charge gst at zero rate to the consumer.

Both taxable supplies including zero export. A zero rated supply is a taxable supply but charged at a vat rate of 0.