Difference Between Gst And Sst Malaysia

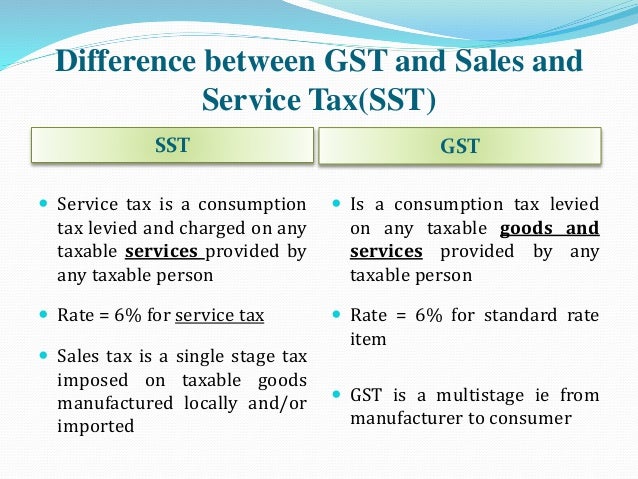

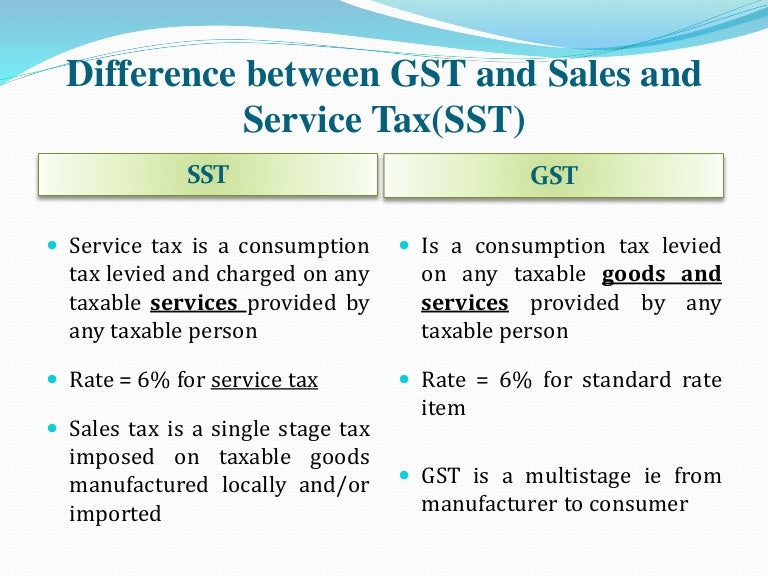

Sst stands for sales and services tax while gst is the abbreviation for goods and services tax.

Difference between gst and sst malaysia. To put it in simple terms generally the gst tend to directly raise prices for the endusers i e. What is sst and how does it differ from gst. Goods and services tax gst gst covers everyone retailers and trades.

Know what s happening understand the fears and be prepared for the change from gst to sst which the 1st stage of implementation happening with zero rated gst this june 2018. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The initial progression of.

Before april 1 2015 there was no value added tax or goods and services tax implemented in malaysia. The above two differences are about the basic differences between gst and sst which is also the fundamental reason why people of our country opposed the implementation of gst in the first place. Both gst vs sst with these single stage taxes were abolished when malaysia s gst was introduced.

The sales tax only covers manufacturers while services tax covers certain prescribed services like professional services. Updated july 28 2018 what is gst and sst goods and services tax gst. Malaysia will remove the gst from june 1 and reintroduce the sst.

Your malaysian gst to sst guide. To put it simply the sst consists of two separate taxes that are governed by two distinct tax laws on goods and services at a single stage. Essentially gst is applied much more broadly than sst and involves different duties and responsibilities.

Difference between gst and sst in malaysia. Before the sst is officially implemented take time to enjoy the honeymoon period of spending money in malaysia. Before you read about the differentiations between these two policies first you should know why gst got finally obsolete in malaysia.

What is the difference between gst and sst. The service tax was governed by the service tax act 1975 and this was also a federal consumption tax. The sales and services tax sst was recently reintroduced back in malaysia as part of pakatan harapan s post election victory manifesto during ge 18.

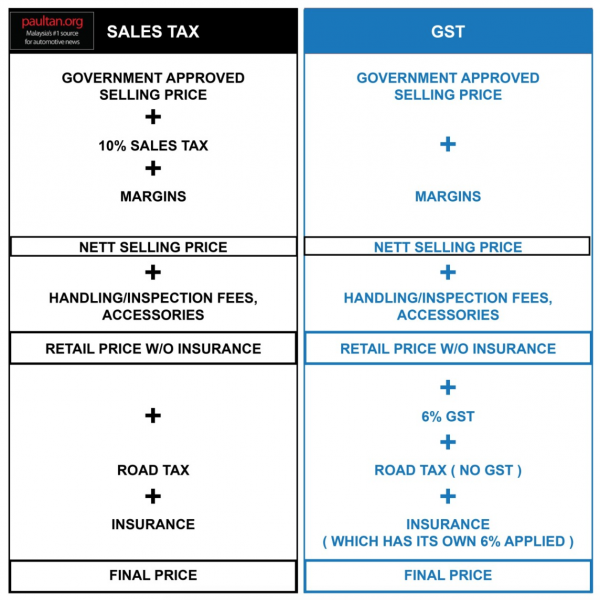

This differs largely from the gst structure we have explained above. The key difference is that the sst is a single staged taxation system usually either at the consumer level or the manufacturer level while gst is multi staged with a system of rebate for those in the intermediate stage. The key differences are as follows.

As mentioned earlier the gst was introduced in april 1 st 2015 with the goal to implement tax on various consumable services and bring wide range of products under value added services. The final consumers the man or woman on the street as the middle person those in between the original producers and the final consumers get to claim rebate. Sales and services tax sst the sales tax is only imposed on the manufacturer level the service tax is imposed on consumers that are using tax services.

As their names suggest both are consumption taxes.