Company Tax Rate 2016 Malaysia

Chargeable income myr cit rate for year of assessment 2019 2020.

Company tax rate 2016 malaysia. Jadual average lending rate bank negara malaysia seksyen 140b. Company with paid up capital not more than rm2 5 million on first rm500 000 subsequent balance. Corporate tax rates in malaysia the corporate tax rate is 25.

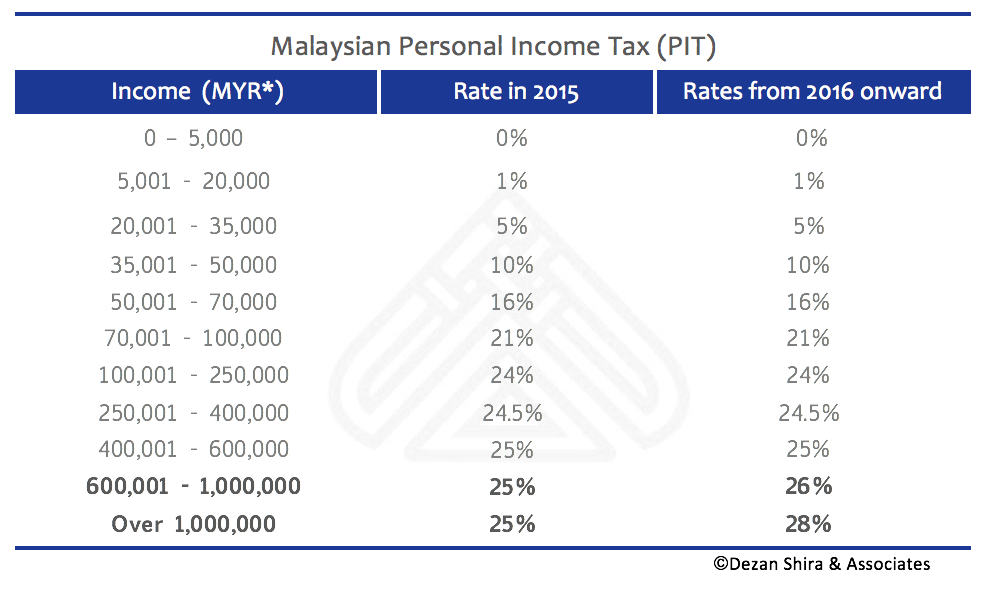

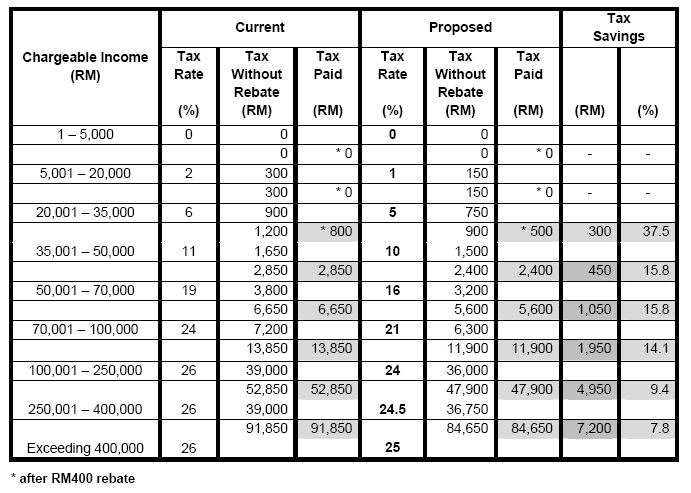

Resident company other than company. A qualified person defined who is a knowledge worker residing in iskandar malaysia is taxed at the rate of 15 on income from an. W e f ya 2016 tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 and chargeable income exceeding rm1 000 000 increased by 3.

Home tax rate of company. Corporate tax rate of 24 effective from year of assessment 2016 for a period of five years with a possible extension for another five years. A company whether resident or not is assessable on income accrued in or derived from malaysia.

The current cit rates are provided in the following table. Tax rates are on chargeable income not salary or total income chargeable income is calculated after tax exemptions and tax reliefs more below. Resident companies with a paid up capital of myr 2 5 million and below as defined at the beginning of the basis period for a year of assessment ya are subject to a corporate income tax rate of 20 on the first myr 500 000 of chargeable income.

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Malaysia adopts a territorial system of income taxation. Malaysia corporate income tax rate.

Year assessment 2017 2018. Malaysia personal income tax rates two key things to remember. Company with paid up capital more than rm2 5 million.

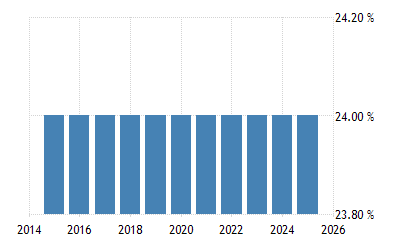

The corporate tax rate in malaysia stands at 24 percent. The following incentives also will be available. Malaysia corporate taxes on corporate income last reviewed 01 july 2020.

A customs duty exemption for goods based companies on raw materials components or finished products brought into free zones for production or repackaging cargo consolidation and integration before. You will never have less net income after tax by earning more. Sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja.

Company with paid up capital more than rm2 5. Company with paid up capital not more than rm2 5 million on first rm500 000 subsequent balance. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Study group on asian tax administration and research sgatar commonwealth association of tax administrators cata inter american center of tax administrations ciat organisation for economic co operation and.